Understanding Price and Sample Computations for Hiraya Homes

June 11, 2024

Navigating the process of buying your first home can be overwhelming. Especially when looking at the financial details. However, understanding the Hiraya Homes price and the sample computations for a house and lot is more straightforward than it might seem. In this blog, we’ll break down the pricing structure and simplify the calculations, making it easier for first-time homebuyers to grasp the essentials. By the end, you’ll have a clear understanding of the costs involved and feel more confident in your journey towards owning a Hiraya Homes property.

Understanding the Sample Computation:

Here are the key terms you’ll typically encounter, and what they represent:

Total Contract Price (TCP)

This is the total cost of properties like a Cavite house and lot for sale thru Pag-IBIG, including the land price, construction cost, and any miscellaneous fees. Understanding the TCP is crucial. It’s the starting point for figuring out all the other costs that come with your new home.

Reservation Fee

The Reservation Fee is a small, non-refundable amount you pay to reserve the property you want to purchase. It ensures that the property will not be sold to anyone else while you complete the necessary documentation and financing arrangements. This fee is typically deducted from your down payment.

Down Payment (DP)

The Down Payment is a percentage of the Total Contract Price that you need to pay upfront. The exact percentage and payment terms can vary depending on the developer and the property. Typically, down payments range from 10% to 20% of the TCP.

Estimated Loanable Amount

After the downpayment is settled, you’ll have to pay the remaining balance thru a housing loan from a from a financing institution like Pag-IBIG Fund. Hence, it is called the Estimated Loanable Amount. Or the amount you’ll be required to borrow thru a loan mortgage agreement. So you can pay the developer the full amount of the property. Think of it as the financial bridge between your savings and your dream home.

Monthly Amortization

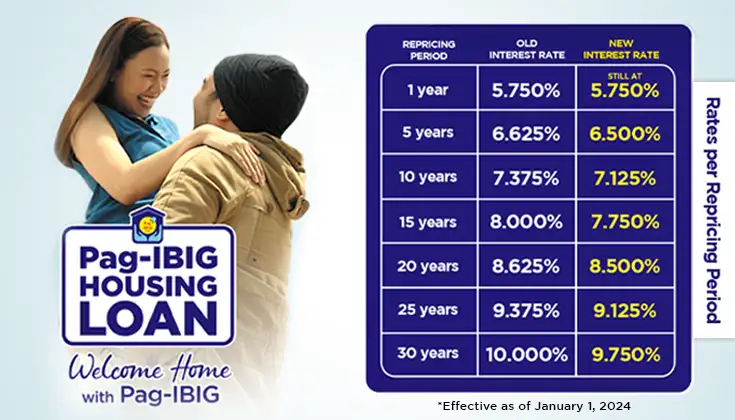

Monthly Amortization refers to the fixed monthly payments you make to repay your housing loan. It covers both the principal amount borrowed and the interest charged by the lender over a set period. Below is the chart of the latest home loan interest rates offered by Pag-IBIG Fund (HDMF) Effective as of January 1, 2024.

Gross Monthly Income Requirement

The Gross Monthly Income Requirement is the minimum monthly income the buyer should earn. This is to ensure that you can comfortably afford the property, like the Hiraya Homes price, based on your chosen financing scheme. It takes into account your monthly amortization, as well as other financial obligations.

Factors that Affect your Monthly Amortization

Home Loan Providers: Pag-IBIG Fund is a fantastic option especially first-time buyers, thanks to its attractive interest rates and longer loan terms. To qualify for a Pag-IBIG housing loan, you must be an active Pag-IBIG member for at least 24 months and meet other requirements such as stable employment and sufficient income. Are ready for a Pag-IBIG Home Loan? Check-out our blog to learn more.

Interest Rates: This is a percentage of the loan amount that you pay to the lender for borrowing their money. Pag-IBIG Fund offers some of the lowest interest rates in the Philippines, making them a great choice for budget-conscious buyers.

Loan Term: This is the length of time you have to repay your loan, typically expressed in years. A longer loan term means lower monthly payments, but you’ll end up paying more interest overall. A shorter term means higher monthly payments, but you’ll own your home sooner and save on interest in the long run.

Making it Work: Estimating Your Monthly Required Income

Affordability Ratio: Buying a house is a significant commitment, and it’s crucial to ensure you can comfortably afford the monthly payments without straining your finances. The Affordability Ratio helps with this. When applying for a Pag-IBIG Fund home loan, lenders use this guideline to determine if you can manage the monthly amortization. Typically, Pag-IBIG Fund prefers a debt-to-income (DTI) ratio of around 35%. This means your total monthly debt payments, including your future house amortization through Pag-IBIG, shouldn’t exceed 35% of your gross monthly income. This ratio helps ensure that your mortgage payments are manageable and sustainable over the long term.

Co-Borrower: If your income does not meet the required threshold, you can consider having a co-borrower (co-maker) who will share the responsibility of the loan. The co-maker’s income is added to yours to meet the affordability requirement, making it easier to get loan approval.

By understanding the price and sample computation for a Hiraya Homes, you are now more prepared to make informed decisions in your homebuying journey. Buying a home is a major milestone that requires careful planning. While the process may seem daunting at first, proper preparation and understanding of the terms can help. Take your time to evaluate your finances, explore options, and seek advice as needed. This will help you turn your vision into reality.

Check-out our House and Lot for Sale in Cavite

Discover our house and lot for sale in Trece Martires Cavite — Hiraya Homes by Pinnacle Homes.

Explore Property

Related News

Latest news, blogs and updates from Pinnacle Homes.

Join our Mailing List

Sign-up and be the first to know about the latest projects, upcoming events, special promos and offers of Pinnacle Homes!