Master the 50 30 20 Rule for Your First Home Budget

August 15, 2023

Purchasing your first home is a significant milestone that brings a sense of accomplishment and security. For many individuals and families in the Philippines, however, the dream of homeownership often feels out of reach due to financial constraints. Poor financial management can hinder the realization of this dream. But there is a solution: the 50 30 20 rule or budgeting principle.

In this article, we’ll delve into the importance of financial management, explain the 50 30 20 budgeting principle, and provide actionable tips to help you embrace this budgeting strategy and save up for your first home.

Importance of Financial Management

In today’s fast-paced world, managing finances effectively often takes a back seat. It’s all too easy to fall into the trap of short-term gratification. For many, the typical mindset upon receiving a paycheck is to allocate funds toward immediate wants, leisure activities, accruing more debt, and, if there’s anything left at all, consider stashing it away in savings.

However, this approach often leads to a cycle of missed opportunities, mounting debts, and delayed financial goals – especially when it comes to the aspiration of owning your first home. It’s time to break free from this conventional mindset and adopt a more strategic approach to financial management that paves the way to affordable homeownership. Without a solid budgeting strategy in place, your dreams of homeownership might remain just that—dreams.

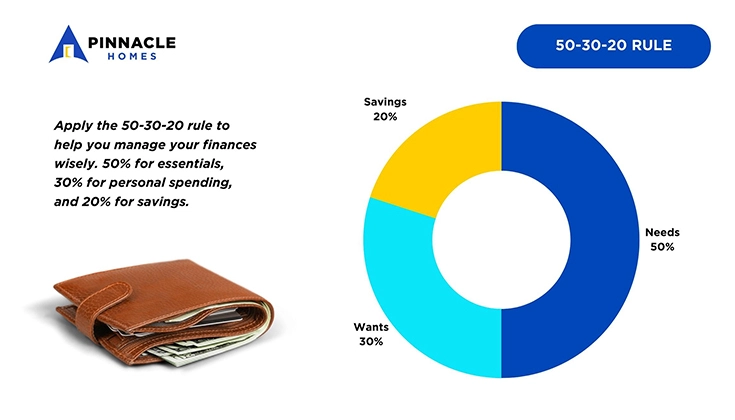

Understanding the 50-30-20 Rule

The 50 30 20 budgeting principle is a simple yet effective approach to managing your finances and achieving your financial goals. This principle advocates allocating your after-tax income into three main categories: Needs, Wants, and Savings. Here’s a breakdown of how it works:

50% for Needs: This category includes essential expenses like housing, utilities, groceries, transportation, and healthcare. Prioritizing your needs ensures that you have a stable foundation for your financial well-being.

30% for Wants: The wants category covers discretionary spending, such as entertainment, dining out, shopping, and leisure activities. While it’s important to enjoy life, this portion of your income should be managed responsibly to avoid overspending.

20% for Savings: The savings category is dedicated to building your financial future. This includes contributions to an emergency fund, retirement accounts, and, in your case, saving up for your first home. Allocating 20% of your income toward savings sets you on the path to achieving your homeownership goal, like owning an affordable house and lot in Cavite.

Practical Tips for Embracing the 50-30-20 Budgeting Principle

Embracing the 50 30 20 budgeting principle requires discipline, commitment, and a willingness to make necessary changes to your spending habits. Here are some actionable tips to help you get started:

Track Your Spending:

Begin by tracking your expenses for a month. This will give you a clear picture of where your money is going and help you identify areas where you can cut back. There are free budget monitoring apps that you can use to help you monitor your expenses. These apps automatically categorize and analyze your spending habits. Not only does this eliminate the need for manual calculations, but it also provides you with visually appealing insights into your financial behavior.

Prioritize Needs:

Start by allocating 50% of your income to cover essential needs like housing, utilities, and groceries. Ensure that you live within your means and avoid unnecessary extravagance.

Manage Wants Wisely:

While it’s important to enjoy life, allocate 30% of your income to discretionary spending with caution. Look for opportunities to cut back on non-essential expenses without sacrificing your quality of life.

Automate Savings:

Make saving a priority by setting up automatic transfers to your savings and investment accounts. This ensures that a portion of your income goes straight to your financial goals before you’re tempted to spend it on non-essentials.

Reduce Debt:

If you have debts, consider directing a portion of the “needs” category towards debt repayment. Reducing debt allows you to free up more funds for savings and future investments.

Set Clear Goals:

Define your homeownership goal and establish a specific timeline. Having a clear target will motivate you to stick to your budget and make necessary sacrifices.

Explore Additional Income Streams:

Consider taking on a side gig or freelance work to supplement your income. The extra earnings can significantly boost your savings and help you reach your homeownership goal faster.

Stay Flexible:

Life is unpredictable, and your financial situation may change over time. Be adaptable with your budgeting and adjust it as needed to accommodate life’s twists and turns.

A Step Closer to Affordable Homeownership

If you’re aspiring to own an affordable home, the 50 30 20 rule can be your trusted companion on this journey. Here’s how it can lead you closer to achieving your homeownership dream:

Consistency is Key: Start by making small but consistent contributions to your savings. With dedication, these contributions will grow, helping you accumulate a sizable down payment for your future home.

Explore Affordable Housing Options: While you’re saving, take the time to explore various affordable housing options available to you. Research and compare homes that fit your budget, needs, and preferences.

Stay Committed: Building savings and achieving financial goals require patience and determination. Stay committed to the 50 30 20 budgeting principle, and remember that every step forward is a step closer to realizing your homeownership dream.

Remember, it’s never too late to start, and with the right financial plan, you can transform your aspirations into achievements. By adopting the 50 30 20 rulee and staying committed to your goals, you are paving the way for a brighter and more secure financial future. Whether it’s owning an affordable home, retiring comfortably, or achieving other dreams, this budgeting approach will serve as your reliable roadmap to success.

Start today, and watch as your disciplined budgeting paves the way to opening the door to your very own affordable home in the Philippines. Visit Pinnacle Homes official website now at www.pinnaclehomes.ph to discover affordable house and lot in Cavite and take the first step towards making your dream home a reality. Start budgeting wisely, harness the power of compound interest, and unlock a brighter future.

Check-out our House and Lot for Sale in Cavite

Discover our house and lot for sale in Trece Martires Cavite — Hiraya Homes by Pinnacle Homes.

Explore Property

Related News

Latest news, blogs and updates from Pinnacle Homes.

Join our Mailing List

Sign-up and be the first to know about the latest projects, upcoming events, special promos and offers of Pinnacle Homes!